The benefits bill - what you need to know

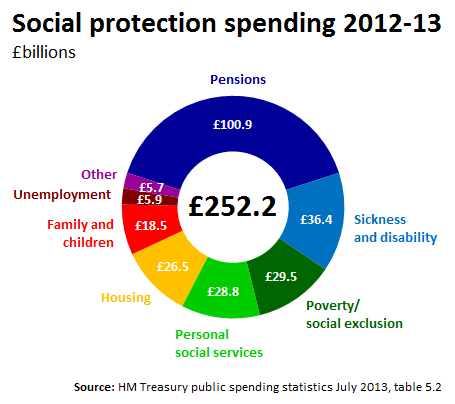

- 'Social protection' accounts for just over a third of all government expenditure.

- This is not the same as what we spend on benefits - a considerably smaller sum.

- Pensions are by far the biggest item on the benefits bill; in comparison, the cost of out-of-work benefits is relatively minor.

Arguably, the defining political issue of this Parliament to date has been welfare reform. In the maelstrom of claim and counter-claim, amidst all the talk of "strivers" and "scroungers", the three main parties have been determining their lines on benefits.

The Conservatives, insisting that welfare spending needs to be brought under control, have with their Coalition partners introduced a range of measures to curb the availability and size of benefit payments - except for pensioners, whose income has been guaranteed under the new 'triple lock' system. The Labour party is currently reviewing its welfare policy, but has argued that the Coalition's cuts are penalising families on modest incomes.

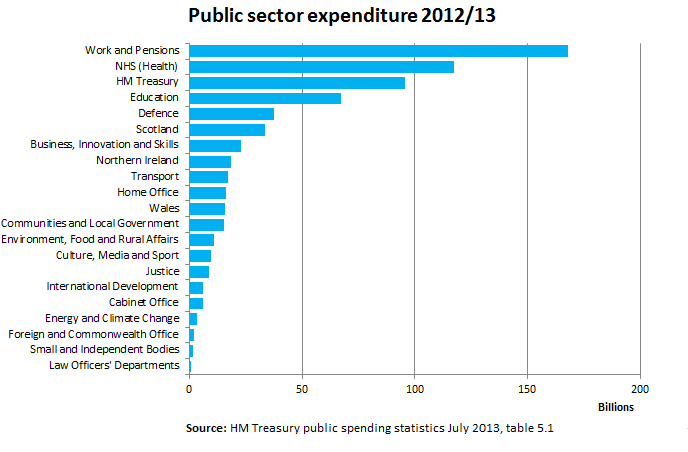

Any discussion about the cost of welfare needs to be put into context. So-called 'social protection' accounts for just over a third of government spending (£252 billion of the £675 billion of public sector expenditure). While the Department of Health and HM Revenue and Customs (a division of the Treasury) contribute to social protection, the Department for Work and Pensions is mainly responsible for this area of spending.

As it stands, the DWP has the biggest budget in Whitehall - by some considerable margin. We allocate more money to benefits and pensions than we do to health, education or defence.

As for how much the government spends on different types of benefits, pensions are the large ticket item on the bill. With our ageing population - and the fact that the government has committed to a year-on-year increase in the state pension - it's likely this will account for an even greater share of expenditure in future.